Streamlining the close process, being able to provide performance data quickly to leadership, and developing strong partnerships with business units are crucial for the success of any finance leader.

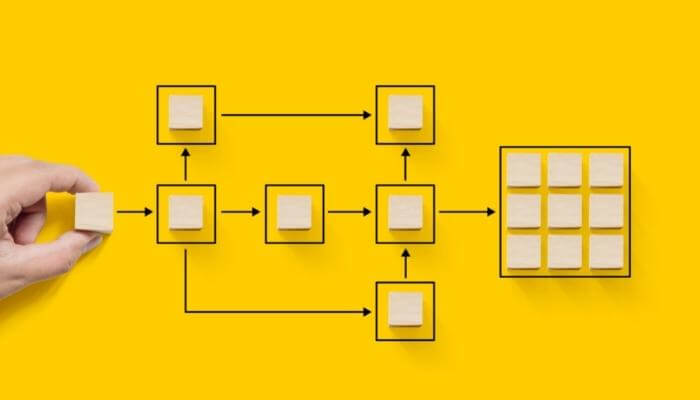

Which is why, after I joined Sensiba, one of my first initiatives was automating as much of the finance function as possible and eliminating tasks that were bogging down our team without adding value to the organization.

As a previous BlackLine user, and knowing Sensiba is a BlackLine Implementation Partner, I was enthusiastic to leverage it again. The Task Management module provides an organized structure that helps us complete the month-end close quickly and accurately. The close process, which used to take 10 to 12 days, is now finished in four days.

BlackLine Task Management Equals More Informed Decision Making

Perhaps more importantly, though, is our ability to help the firm’s leaders make better business decisions by providing them with month-end performance data sooner. Before adopting BlackLine, we couldn’t offer this data until nearly halfway into the following month. This, of course, is too late for leadership to make any meaningful decisions quickly enough to affect that month’s results.

By providing data earlier, we can make more effective decisions about hiring levels or areas of our business that are either expanding or not growing as expected.

Similarly, completing the month-end close sooner opens additional time for the finance team to conduct a meaningful analysis of the previous month’s results. As we perform our flux analysis, we know that we’ve completed all of our required transactions. That, in turn, makes our analysis of the numbers more effective because we don’t need to worry that any variances could have been caused by mistakes, such as a journal entry not being booked. This makes the downstream implications of our month-end close process a lot easier to understand.

Easily Know the Who, What, When, Where, and Why

In addition, BlackLine’s Task Management dashboard helps us see, at a glance, the status of our completed and pending tasks — as well as what everyone on the team is working on. As the controller, I can see the tasks being prepared, what’s in review status, and what’s been approved. The dashboard also helps me identify any potential challenges or roadblocks that could impact our month-end close.

Based on this success, we’re looking at other finance team functions ripe for automation, such as our payroll, reconciliations, and other routine tasks, as well as additional ways to streamline our month-end close even more.

Helpful Tips from One Finance Professional to Another

In closing, I wanted to share some tips for finance professionals considering initiatives to improve efficiency and build deeper relationships with leadership.

- Understand your goals. A faster close is desirable by itself, but the true value lies in helping leadership apply the data to understand business performance, identify opportunities, and make better decisions.

- Identify processes and tasks you can automate. Spreadsheets are great for their desired purpose but are less effective as automation or project management tools.

- Look for integrations with your existing tools. Being able to flow data automatically from one application to another increases speed and accuracy and frees team members for more valuable tasks.

- Consider outside help. As you plan to automate processes, consider bringing in external expertise to help implement and provide ongoing support. This will improve your efficiency and the return on your automation investment.

To learn how BlackLine can streamline your financial processes, reach out to our BlackLine Gold Partner team. And if you’re a finance professional, don’t hesitate to connect with me on LinkedIn.