R&D capitalization and amortization are here, and we recommend planning as though it’s here to stay. Since the 1950s, businesses that incurred R&D expenses under Section 174 have been able to deduct them as incurred. Unfortunately, the Tax Cuts and Jobs Act (TCJA) of 2017 changed this for tax years starting in 2022. Like many in the R&D Credit and tax accounting spaces, we expected that R&D amortization would be done away with or at least delayed, but while several congressional bills were proposed, none made it through into becoming law prior to the extended 2022 tax filing deadlines of 9/15 and 10/16/2023.

Even though drafts of the Build Back Better Act (BBBA passed in August 2022) did attempt to push R&D amortization out to 2026, those changes did not make it into the final bill. While the deadline may be pushed out with another piece of legislation, at this point we recommend planning for the impact as though it won’t be. Taxpayers taking advantage of R&D expense deductions could be hit with an increased tax liability.

What’s Different About R&D Capitalization

The TCJA legislated that R&D costs must be capitalized and then amortized over a period of 5 or 15 years for domestic and international costs, respectively.

Historically, taxpayers deducted the full amount of their non-capitalized R&D expenses in the year incurred. Starting in tax years beginning after 12/31/2021, this deduction will be spread out over a period of years. This reduces the value of the R&D expenses in the current tax year and can impact taxable income.

R&D Capitalization Broken Down

How it Used to Work

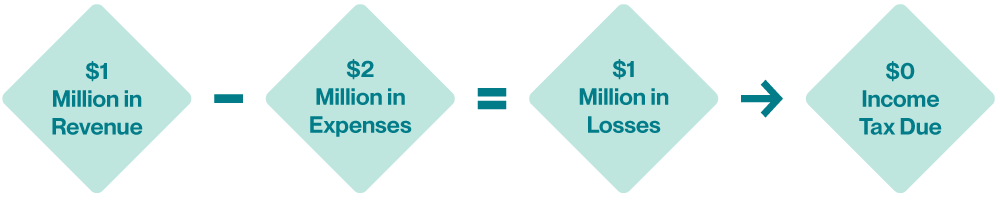

The current process is relatively straight-forward: whatever you expense as R&D, you can write that full amount off for the tax year in which the expenses are incurred. Often this leads to a limited or nonexistent tax bill for start-up companies heavily investing in R&D.

For example, if a company has $1 million in revenue and $2 million in R&D expenses, it will have a net loss of $1 million and therefore do not generate any current year income tax liability.

How it Will Work

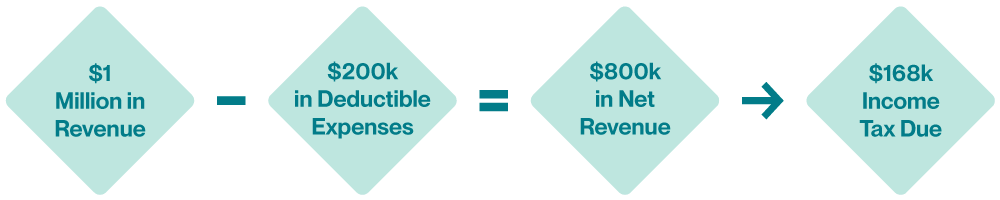

Taxpayers who usually depend on R&D expense deductions may be hit with a surprise. They will only be able to write 1/5 of the amount of domestic expenses or 1/15 of expenses for global expense. In addition, because of the requirement to use the mid-year amortization convention, the company will only be allowed half of the deduction in the first year (the other half comes in year 6 or 16).

Let’s apply the new guidelines to the same $1 million dollars in revenue and $2 million in US R&D spend used above. Now we must capitalize and amortize, deducting $200,000 in 2022, $400,000 from 2023-2026, and $200,000 again in 2027. In this case, for 2022 our equation is $1 million revenue – $200k amortization = $800k in revenue. At the corporate tax rate of 21%, the income tax due is $168k and has a substantial impact on businesses if not planned in advance. The deduction for the remaining $1.8 million isn’t gone, it’s just spread out over several years.

Note that if a company’s R&D spending is flat, in the 6th year, the carried forward amounts from the 1st – 5th year will add up to the amount that would have been deductible before the change. This effectively creates a “phase-in” period for all companies from 2022 through 2026 and any start-up in their first years.

|

Old Way |

||||

| Year | Percentage Use | Amount Generated | Amount Used | |

| 2021 | 100% | $2,000,000 | $2,000,000 | |

|

New Way |

||||

| Year | Percentage Use | Amount Generated | Amount Used | |

| Year 1 | 2022 | 10% | $2,000,000 | $200,000 |

| Year 2 | 2023 | 20% | $0 | $400,000 |

| Year 3 | 2024 | 20% | $0 | $400,000 |

| Year 4 | 2025 | 20% | $0 | $400,000 |

| Year 5 | 2026 | 20% | $0 | $400,000 |

| Year 6 | 2027 | 10% | $0 | $200,000 |

NOLs Impact & R&E Credit Impact

The changes to R&D capitalization and amortization will also impact how companies utilize Net Operating Losses (NOLs). NOLs account for how much a business “lost” in a given year. R&D capitalization will reduce the amount of NOL generated because only a portion of R&D expenses will be deducted each tax year.

Section 41 and Section 174

This change makes expenses that qualify for the Research & Experimentation tax credit under Section 41 (R&E Credit, often called the R&D Credit) more valuable. Expenses incurred for the R&E Credit under Section 41 are also includable under Section 174, though the 174 R&D expense definitions are broader and include foreign R&D.

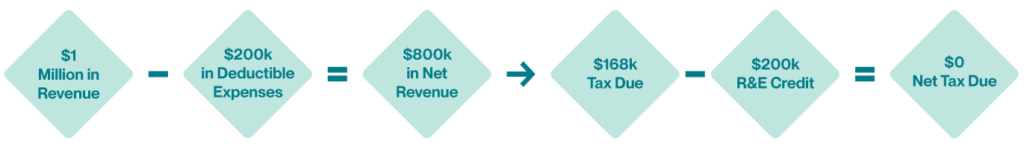

Even though the company can no longer claim all of deduction for the Section 174 R&D expenses in the year incurred, they can still include any eligible expense for that year’s Section 41 R&E credit. While the deductions are applied to the revenue, the R&E credit is applied after corporate taxes are calculated, resulting in dollar-for-dollar reduction in the tax owed. Any credits not used in the year generated can be carried forward indefinitely.

Additionally, beginning in tax year 2021, any NOL generated can only be used to offset 80% of taxable income in future years. Companies who would have historically been able to use NOL carryforwards and R&D expense deductions to reduce their tax liability will be doubly impacted by these changes starting in 2022.

Continuing the example from above, the $2 million in R&D expenses would generate an R&E credit of as much as $200k (20% credit on expenses over a threshold of at least 50% the expenses, so 20% of $1M excess qualified research expenditures (QREs)). With that same $168k bill, the R&E credit can now bring the tax bill back down to $0, and carry forward $32k into future periods.

Listing Expenditures on a Tax Return

Since Congress has not agreed to restore capitalization and amortization of Section 174 R&D expenses from mandatory to elective, the IRS has authorized an automatic approval process for the change in accounting methods process required.

Rev. Proc. 2023-11 outlines the process the IRS uses instead of the waived Form 3115, Application for a Change in Accounting Methods. Under this process, each taxpayer must submit a statement with the return in lieu of the Form 3115 (including the duplicate copy filing):

- Taxpayer name and ID

- Beginning and end dates of the year of change. Typically, this will be the taxpayer’s tax year 2022

- The designated Automatic Accounting Method Change number under section 7.02(8): 265

- A description of the expenditures included as specified R&D

- The amount of expenditures included in item 4

- A declaration that “[Taxpayer] is changing the method of accounting for specified research or experimental expenditures to capitalize such expenditures to a specified research or experimental capital account, and amortize such amount over either a 5-year period for domestic research or 15-year period for foreign research (as applicable) beginning with the mid-point of the taxable year in which such expenditures are paid or incurred in accordance with the method permitted under § 174 for the year of change. [Taxpayer] is making the change on a cut-off basis.”

The amounts identified are then entered on form 4562 – Depreciation and Amortization part VI and the associated schedules.

Help Unraveling the R&D Expense Capitalization Puzzle

Do you think the changes to R&D capitalization and amortization might impact you? Contact our team to learn about potential impacts and planning opportunities.