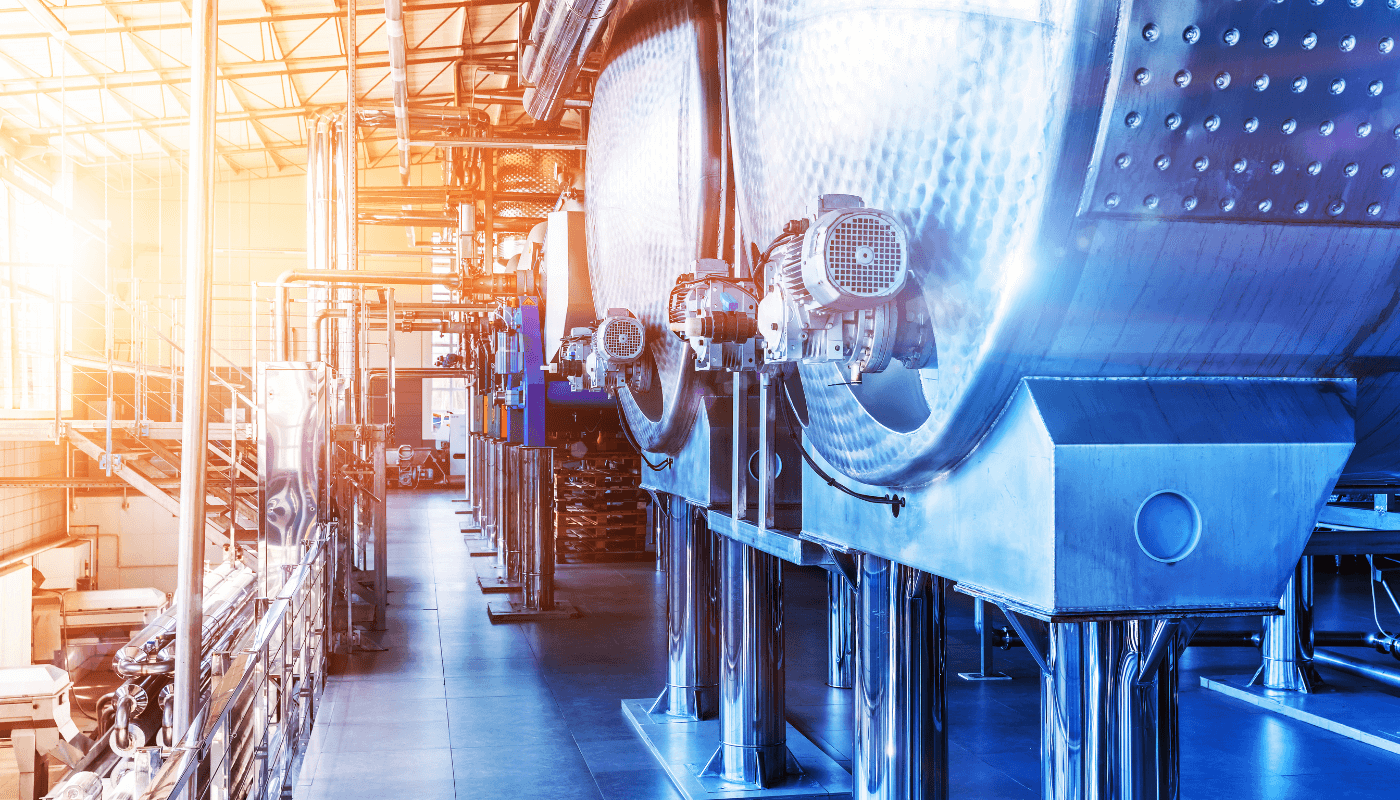

After the crippling consequences of the COVID-19 pandemic in 2020, the manufacturing and construction industries have managed to get back on top in 2021. The 2022 trends for these industries are also favorable, indicating continued growth and recovery. Revenue growth in 2021 is projected to be approximately 6.5% and 6.9% for the manufacturing and construction industries respectively, and will likely gain momentum in 2022. Demand and backlog orders are stronger than ever, and many suppliers rush to satisfy their clientele.

Despite this prosperity, organizations are still plagued by the unforeseen side effects of the COVID-19 pandemic, even two years later. Here are some issues still impacting the manufacturing and construction industry:

Supply Chain Delays

Companies continue facing project delays due to lockdowns and disruptions in the global supply chain. U.S. port delays are higher than in other developed economies, with a historical turnaround time average of 3.5 days, now at over six days. While these factors dampened performance in 2021, we expect them to heighten performance in 2022 as inventories are replenished and more projects are scheduled for completion with less restrictive lockdowns. We can also expect companies to adjust their logistical needs to face these disruptions, as delays will continue well into 2022.

Trouble in China

Power outages in China affected factory production. The Chinese government appears to be pressuring manufacturers to follow environmental guidelines and shutting down factories that are not compliant, causing inventory shortages. The real estate company Evergrande defaulting on its credit obligations is another factor to consider. With a reach in multiple markets, the fate of this real estate giant is bound to have a ripple effect globally.

Worker Shortages

The “Great Resignation” has caused many organizations to see an unprecedented loss of talent. Many companies are trying to acquire new employees by offering work-life balance incentives and sign-on bonuses. As a first-time occurrence, speculations would be that organizations will go above and beyond to retain talent by providing a healthy and rewarding work environment, from maintaining dynamic contact with their team as more and more work remotely to making them feel valued and accepted.

Retaining talent will be more and more challenging considering the amount of new job openings and the urgent need for companies to fill vacant positions, and the increasing ability for employees to negotiate the terms of employment.

Shipping Costs

As demand increases and supply decreases, we are experiencing skyrocketing freight costs. Shipping costs have been doubled, tripled, quadrupled, and even multiplied by ten, largely due to ocean carriers accused of price gouging. Businesses are then billed for storage of goods while their shipments are delayed. Ports are also facing a shortage of chassis due to empty containers piling up, while there are so many full containers needing to reach their destination.

While the market is adjusting with both men and women from other industries joining the trucking/shipping industry to meet rising demands, it is unclear if smaller companies can survive such a blow if they cannot get their inventory. Closing the gap of a talent to demand ratio of roughly 1:6 will be challenging to say the least.

Inflation Rates

The inflation rate is reaching record highs. There was a 6.8% increase in December 2021 compared to December 2020, the fastest pace in 40 years. In December 2021, the Federal Reserve expressed its consideration to raise interest rates three times in 2022 while starting to cut purchases of Treasury securities and mortgage-backed securities as soon as January 2022.

Businesses are waiting to see how much the Federal Reserve will adjust the interest rates and whether it will push for new restrictions on banks. Changes will impact the borrowing abilities of the manufacturing and construction industries and their expanding capacity as the cost of doing business rises.

Survival of the Fittest for Manufacturing and Construction

Even though we expect the manufacturing and construction industries to keep growing in 2022, the results will not be uniform. Success will depend on how dynamic and flexible companies can be. Businesses must be nimble enough to address their shortcomings on a case-by-case basis by seizing growth opportunities, acquiring new talent and avoiding labor shortages, facing rising costs, maintaining profit margins, and managing inventory shortages.

Not sure how to manage your supply chain in 2022? Click here for strategies small businesses can use to navigate supply chain disruption.