Managing your company’s finances isn’t always easy. Things were probably a lot simpler in the early days of your business. The financial responsibilities were, and maybe still are, handled by a single person in your business.

But as your business grows, your accounting needs grow with it. Expecting one person or a small department to continue handling everything is unreasonable, even risky. At this point, many companies consider outsourcing their accounting services to an expert.

If you’re one of those companies, ask yourself – what kind of outsourcing services you need? Should you get help with basic accounting obligations or seek out the expertise of an outsourced CFO?

We’ve pulled together some information to help you answer those questions. Decide what kind of outsourcing best fits your practical and strategic needs. Once you put that missing piece in place, consider your accounting department at full strength.

The Nuts and Bolts of Accounting Services

Outsourced accounting services handle the most ordinary (and therefore most important) aspects of your business finances. They are the time and labor-intensive obligations your in-house accountant may not have enough resources to complete on time or in full. For example, an accounting service might provide the following:

- Bookkeeping and accounting management

- Financial statements and reports

- Financial process improvement

- Accounts receivable management: billing, invoicing, etc.

- Accounts payable management

- Payroll management

Consider accounting services as your basic financial obligations – the things your company must do to keep the books in order and the bottom line in the black.

Outsourced CFO Services – It’s Like Having a CFO In Your Back Pocket

An outsourced CFO is exactly what it sounds like. Instead of hiring a financial executive for your company, you partner with a service provider that can replicate their responsibilities. CFO services typically provide higher-level accounting functions focused on your organization’s financials. Their support might include:

- Operational and financial reporting

- Cost and cash flow management

- Profit analysis

- Metric and KPI (Key Performance Indicators) tracking

- Business process design

- Raising debt or equity capital

- Advising and consulting on strategy

- Forecasting new business ventures

Consider CFO services as the company’s strategic brain – the source of ideas and insights that decision-makers use to create projections, forecast disruptions, engineer growth, and plan for the future.

Upgrade Accounting and Achieve Excellence

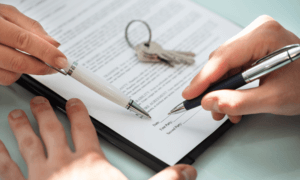

Here’s a helpful way to think about your two outsourcing options: Accounting services are backward-looking, examining what a company has already done. On the other hand, CFO services are forward-looking, studying what companies have yet to do.

Which direction do you need help with? Could you use some assistance with the day-to-day aspects of accounting, or do you need someone to bring the big picture into perspective? Maybe you need a little of both? Our team is happy to customize an outsourcing option around your needs. When you’re ready to continue this conversation, don’t hesitate to contact us.